Understanding your sewer volume charges

From 1 July 2025, a 2.5% increase will apply to sewer volume charges.

Business bills are generally made up of the following charges. On this page, you will learn about your sewer volume charges.

- Water use charge

- Sewer volume charges

- Service charges

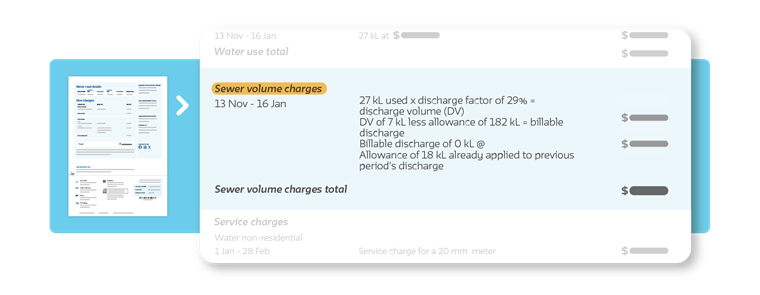

The breakdown of the charges that apply to you can be found on the back of your bill.

Your sewer volume charges

Sewer volume charges are based on the water used and returned as wastewater to the sewer.

The charges only apply if you discharge more than 200 kilolitres (kL) of wastewater to the sewer during a financial year.

The charge is $4.352 per kL discharged.

New buildings are exempt from sewer volume charges for the first 12 months. This allows you to monitor your water use and see how much wastewater you discharge. After 12 months, you will receive your first sewer volume charge included in your bill.

How do you calculate the sewer volume charges?

It’s based on the percentage of the water used at the property discharged to the sewer – this is called the discharge factor. Your discharge factor will either default to 95% of the water used or another amount based on an individual assessment of your business. Please contact us to arrange an individual assessment.

Based on your discharge factor, we calculate the total wastewater discharged to the sewer minus the 200kL discharge allowance and charge $4.352 per kL discharged.

Discharge factor assessments

When we assess the discharge factor, we consider any water used in production processes, evaporative air conditioners, watering of grounds or other purposes. This provides a fair reflection of how much wastewater your business discharges into the sewerage.

Some commercial and industrial properties are billed trade waste charges. In this case, we will adjust the discharge factor to consider the trade waste component.

Cooling towers, gardens and production processes can use large quantities of water. We recommend you install separate meter/s so we can more accurately assess the amount of water your discharge to the sewer.

Sewer volume charges examples

Example calculation 1

For a business that has used 3,000kL of water and has a discharge factor of 33% in a financial year, your sewerage volume charges would be calculated as follows:

33% of 3,000kL = 990kL of wastewater discharged to sewer990kL – 200kL discharge allowance = 790kL

790kL x $4.352 = $3,438.08

Example calculation 2

For a business that has used 1,000kL of water and has a discharge factor of 10% in a financial year, your sewerage volume charges would be calculated as follows:

10% of 1,000kL = 100kL of wastewater discharged

No charge, as this is within the 200kL discharge allowance.

Fixed business charges

In some situations, other sewerage charges may apply instead of the standard charges.

Commercial nursing homes

- The sewer discharge allowance is 75 kL per bed. The remaining sewerage volume charge is $4.352 per kL discharged to the sewer.

Caravan parks

- Caravan parks are entitled to a 200 kL discharge allowance plus an additional 75 kL for each long-term residential caravan bays.

Some businesses may be eligible for a discount on their sewer volume charges. Learn more about discounts for businesses.